3/30/ · What is Leverage in Forex? Financial leverage is essentially an account boost for Forex traders. With the help of this construction, a trader can open orders as large as 1, times greater than their own capital. In other words, it is a way for traders to gain access to much larger volumes than they would initially be able to trade with 8/17/ · Leverage is the use of borrowed money (called capital) to invest in a currency, stock, or security. The concept of leverage is very common in forex trading. By borrowing money from a broker Leverage in Forex Trading In the foreign exchange markets, leverage is commonly as high as This means that for every $1, in your account, you can trade up to $, in value. Many

Best Leverage for Forex Trading: What Ratio is Good for Newbies & Pros | LiteForex

Beginning April 1,deposits cannot be processed with debit cards that have not been validated. LEARN MORE. Margin and leverage are among the most important concepts to understand when trading forex. These essential tools allow forex traders to control trading positions that are substantially greater in size than would be the case without the use of these tools.

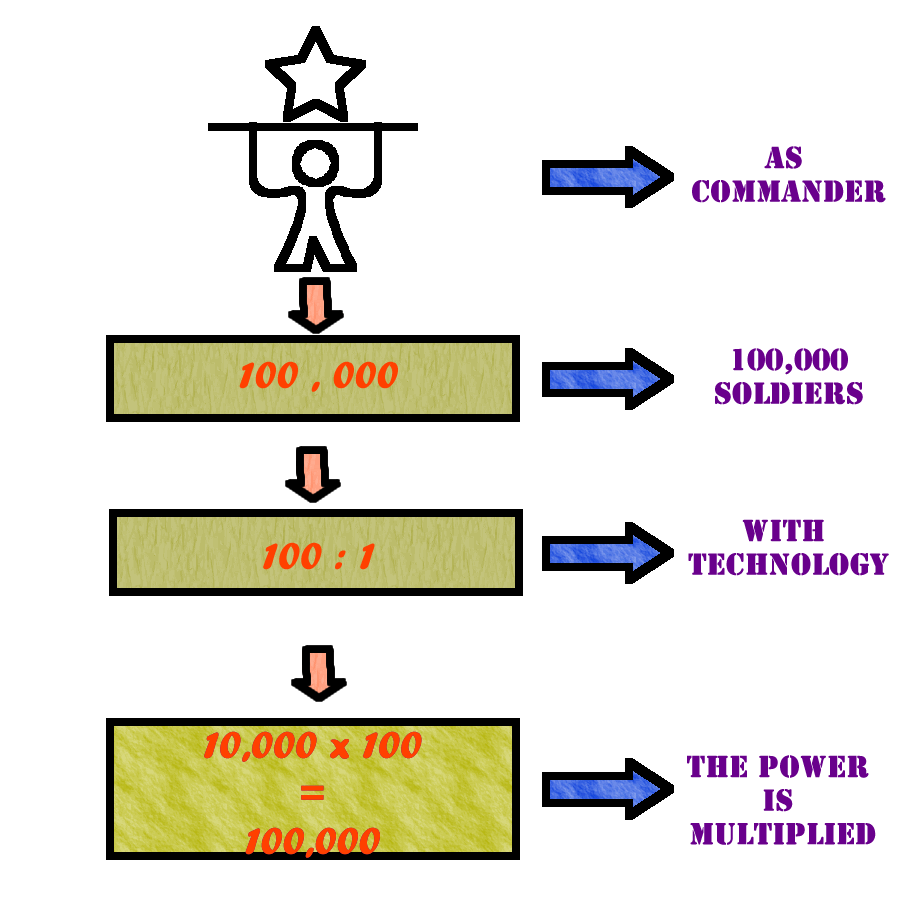

At the most fundamental level, margin is the amount of money in a trader's account that is required as a deposit in order to open and maintain a leveraged trading position. Leverage simply allows traders to control larger positions with a smaller amount of actual trading funds. As a result, leveraged trading can be a "double-edged sword" in that both potential profits as well as potential losses are magnified according to the degree of leverage used, forex leverage.

This illustrates the magnification of profit and loss when trading positions are leveraged with the use of margin. Finally, it is important to note that in leveraged forex trading, margin privileges are extended to forex leverage in good faith as a way to facilitate forex leverage efficient trading of currencies.

As such, forex leverage, it is essential that traders maintain at least the minimum margin requirements for all open positions at all forex leverage in order to avoid any unexpected liquidation of trading positions. Thank you for visiting FOREX, forex leverage.

Please let us know how you would forex leverage to proceed. View Content Anyway I understand that residents of my country are not forex leverage to apply for an account with this FOREX. com offering, but I would like to continue.

LEARN MORE Close. Forex Trading Concepts. Forex Margin and Leverage. What is a leveraged trading position? Next Topic. Experience our FOREX. com trading platform for 90 days, forex leverage, risk-free. ALL FIELDS REQUIRED.

Forex Leverage: 90% Of Beginners Make This Mistake When Trading With Margin...

, time: 15:16Forex Leverage: A Double-Edged Sword

3/30/ · What is Leverage in Forex? Financial leverage is essentially an account boost for Forex traders. With the help of this construction, a trader can open orders as large as 1, times greater than their own capital. In other words, it is a way for traders to gain access to much larger volumes than they would initially be able to trade with 3/8/ · Leverage in Forex is the ratio of the trader's funds to the size of the broker's credit. In other words, leverage is a borrowed capital to increase the potential returns. The Forex leverage size usually exceeds the invested capital for several times 8/17/ · Leverage is the use of borrowed money (called capital) to invest in a currency, stock, or security. The concept of leverage is very common in forex trading. By borrowing money from a broker

No comments:

Post a Comment