16/05/ · This is when a market is oversold or overbought in the sense that it’s an event that can be traded for profit. The more volatile and less liquid the market is, the bigger these swings around the real value can be. This is displayed in Figure 1. Reasons for rapid price changes. Before trading an overbought/oversold market we should always try to find the reason for it getting into an extreme Overbought and Oversold - Don't Follow The Trend Blindly! 01/01/ · Overbought and oversold are two terms that often appear in forex trading analysis. These two conditions are very important. Every trader should spend some time to learn and understand these conditions because they could assist in reviewing the current price conditions and then formulate some steps to deal with this situation. But before we discuss it further, let's get acquainted with the definition Author: Fayth

Overbought and Oversold - Don't Follow The Trend Blindly!

This statement is quite subjective. Overbought and oversold have come to be a throw away statements; the same as saying that the market has moved up or down some range without any reversal. Something this vague is of limited use to a trader. It is moving to the new price as it should. Of course in the real world they never work like this.

The valuation of currencies, stocks, bonds and most other assets is open to interpretation. The market is always trying to find this fair value because buyers will not want to buy above fair value and sellers will not want to sell below fair value. By and large markets are pretty good forex overbought getting close to fair value most of the time.

Extremes tend to happen at times of rapid changes. At these times fair value and market value are not the same. They can be wide apart, forex overbought. The more volatile and less liquid the market is, the bigger these swings around the real value can be.

It might take a bit of investigation but this knowledge allows us to better understand if the new level is warranted and anticipate what may happen next. All of the above situations can happen in forex markets. Some actually happen on a daily basis. Though these might cause the market to overshoot or undershoot in a trivial way. Trading on these events can be very profitable — providing forex overbought timing is right.

Liquidity black holes can cause enormous price movements in a short time. So can mass hysteria but these events can last for forex overbought long period of time — sometimes years.

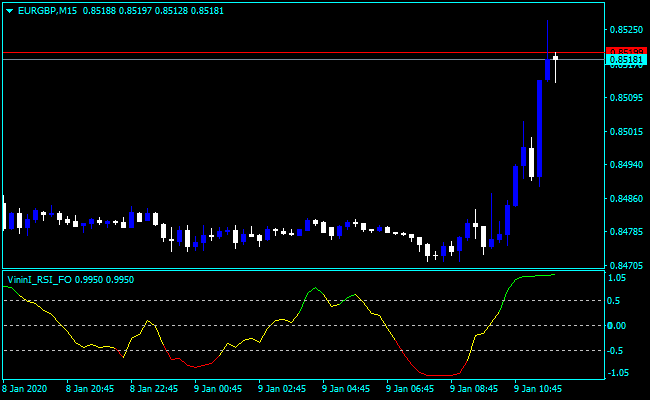

Both are special situations that need careful analysis, forex overbought. This effect can be measured on most of the major pairs and many of the minors as well, forex overbought. Pair Overbought correction Oversold correction EURUSD forex overbought The table above shows the percentage of times that a correction happened after the market reached an overbought or oversold level.

This was measured by distance from the long EMA line and the MACD oscillator. The data covers the past decade and is from the H4 chart four hour. With EURUSD for example, when the market became overbought, In What this test proves is that most currencies do show evidence of pushing back the other way after reaching overbought or oversold levels. The strength of that push is forex overbought proportional to the amount the market is forex overbought or overbought in the first place, forex overbought.

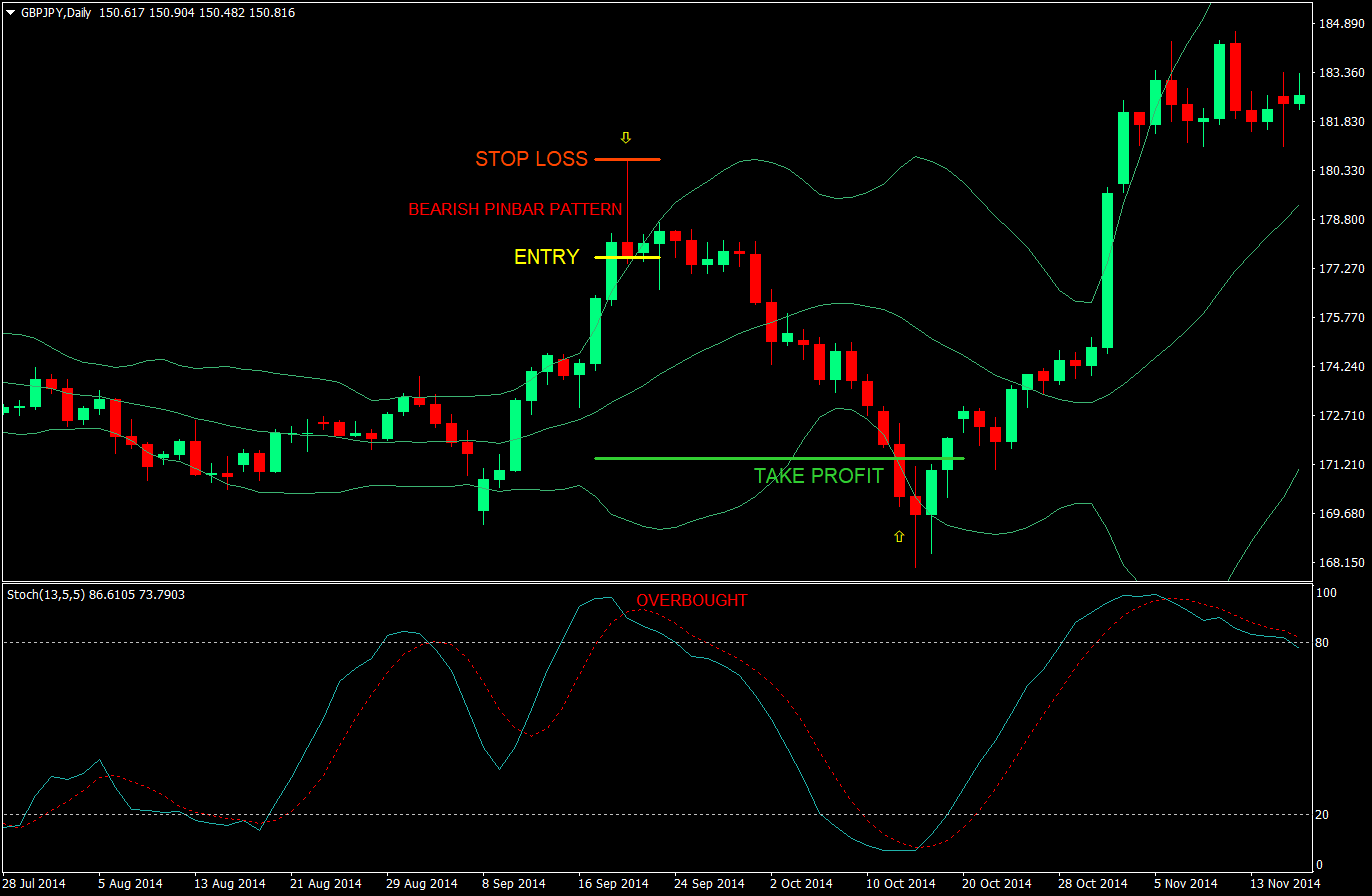

The opposite is true of sellers. This is a case of seeing what you want to see, forex overbought. When a trader enters too early, what can happen next is that the market extends further and further against their position until they are forced out — often just before the real correction happens, forex overbought.

While there are many indicators out there that will do the job, nothing beats inspecting the chart yourself to get an idea of what is going on, forex overbought.

None of the above is consistently reliable on its own. But looking together gives a clearer picture and allows you to get a feel for if the market is heavy on one side or the other, forex overbought. Often the catalyst can just be a market close — like a weekend or a public holiday. This break gives traders and analysts time to digest the current state of affairs. Sentiment changes dramatically as the market reopens. If good or bad news is anticipated by a few in the know, the price will start to adjust shortly before the forex overbought release.

Essential for anyone serious about making money by scalping. It shows by example how to scalp trends, retracements and candle patterns as well as how to manage risk. It shows forex overbought to avoid the mistakes that many new scalp traders fall into. If the rumor turns out to be wrong, forex overbought, the market will snap back sharply in the other direction, forex overbought. But if the rumor turns out to be true, the market can still pullback — though not by quite as much.

This pullback happens due to positions being closed to book profits. This can push the price to a more extreme overbought-oversold level. This raises the odds of sharp pullback after the news officially breaks, forex overbought we can trade on, forex overbought.

Start here Strategies Technical Learning Downloads. Cart Login Join. Home Trading. Market commentators use the words overbought and oversold quite loosely. Overbought-oversold markets © forexop. Figure 1: Markets are always trying to find fair value © forexop. Copyright © forexop.

Wyckoff Chart Analysis: A Simple Overview Wyckoff analysis was born out of years of practical study of the stock price boom and bust cycles, forex overbought. Importance of Hidden Support and Resistance Hidden support and resistance is virtually unknown to a majority of traders.

Yet this phenomenon is How to Read an Ichimoku Chart Ichimoku is an all-in-one system that can be helpful when trying to figure out trending, reversals, forex overbought, How to Use Relative Strength Index to Make Trading Decisions The real value of the RSI is in predicting when the price may be at a point where a significant correction Catching the Pullback Trade Many traders soon learn that pullback trading can be a killing-ground that traps the unwary on the wrong The ADX Indicator and Its Uses When you do any kind of trend trading, the ADX is one indicator that you will want understand well No Comments.

Leave a Reply Cancel reply. Leave this field empty. Contact Us Timeline FAQ Privacy Policy Terms of Use Home, forex overbought.

Why OVERBOUGHT And OVERSOLD Is Not Working For You - And How To Fix It

, time: 9:21How to Spot an Overbought or Oversold Market - Forex Opportunities

01/01/ · Overbought and oversold are two terms that often appear in forex trading analysis. These two conditions are very important. Every trader should spend some time to learn and understand these conditions because they could assist in reviewing the current price conditions and then formulate some steps to deal with this situation. But before we discuss it further, let's get acquainted with the definition Author: Fayth 16/05/ · This is when a market is oversold or overbought in the sense that it’s an event that can be traded for profit. The more volatile and less liquid the market is, the bigger these swings around the real value can be. This is displayed in Figure 1. Reasons for rapid price changes. Before trading an overbought/oversold market we should always try to find the reason for it getting into an extreme Overbought and Oversold - Don't Follow The Trend Blindly!

No comments:

Post a Comment