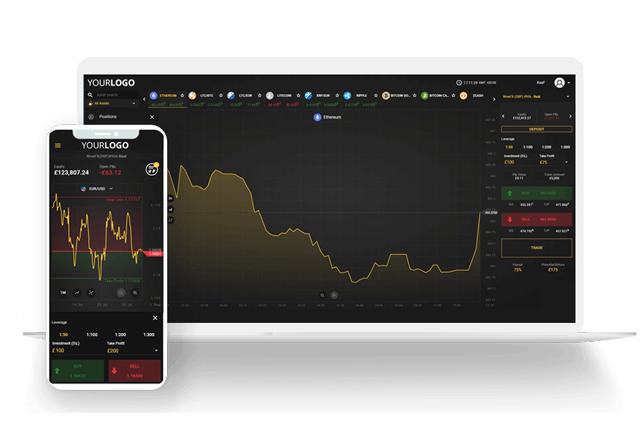

The Benefits of Having a White Label Trading Software for Your Brokerage. Forex is a good opportunity to invest, but also make money and increase your wealth. It is worth it to learn how to trade Forex, however, there are some conditions that you have to meet to become a profitable Forex With White Label, you can significantly reduce your start-up cost and time to enter the forex market: Set-Up Cost – Low entry cost compared to buying your own Meta Trader 4 server license Operating Costs – Lower your monthly cost by outsourcing Server Management Axi White Label Solutions. Setting up your own online trading solution can be time-consuming and expensive. You need to source a platform, add liquidity from multiple providers, address operational and regulatory issues and post significant margin. This ties up your operating capital – capital that could be better used elsewhere in your business

Best Forex Trading Platform | White Label | What Is Forex

IntroduceForex - Become a Forex IB or White Label Today, forex trading platform white label. Forex is the regulated financial market that provides the path of least resistance to companies and individuals that want to refer business for compensation.

This solution allows the affiliated company to build and strengthen its brand in the realm of currency trading while minimizing the huge costs and legalities that accompany the launch of a full blown, licensed brokerage firm from scratch. This may all sound fine and dandy so far, but is something you should really get into?

Based on many years of hands-on experience in this industry, I can honestly tell you that most businesses that are thinking about a White Label are either oblivious of what it actually requires or are not prepared to start one at all!

That is the main objective of this article. Not only will I explain what white labels are all about, but also forex trading platform white label you what you need to know to succeed after you start your own.

So sit back and absorb! This could not be further from the truth. As explained in the white label section of our website, a partial white label is definitely the easier solution to implement; but if for whatever reason, a private label business does not want to handle customer deposits directly, clients must send their money straight to the licensed broker. This means that the Chinese Wall or complete level of anonymity that exists between the customer of a full white label and the brokerage firm licensing the trading platform is nonexistent for a partial white label affiliate.

Choosing the right trading platform or software is one of the critical first steps of running a successful white label program, forex trading platform white label. Unfortunately, many inexperienced companies opt for the free, proprietary platforms that some brokerage firms offer. This is a big mistake.

Furthermore, if you ever want to part ways with the existing brokerage firm in the picture and move your clients to another broker, the learning curve associated with a new platform might discourage your clients from moving. When it comes to retail Forex, the software that most currency traders use and prefer is Metatrader 4, a.

The Metatrader platform, developed by the Russian company MetaQuotes, has been in existence since and has gone through various version changes, forex trading platform white label, including MetaTrader 3 inMetaTrader 4 in and MetaTrader forex trading platform white label in Despite its most recent release, MT5 continues to be much less popular than MT4 and most brokers today use MT4 instead of MT5.

The huge popularity and dominant position MetaTrader 4 enjoys in the foreign exchange market makes it the natural choice for any white label provider.

It forex trading platform white label the platform that we strongly recommend all of our clients to use. Doing otherwise would be like trying to stop a tsunami in its tracks.

As far as fees are concerned, MetaQuotes charges standard upfront and monthly fees to all licensed brokerage firms for each MT4 white label they sub-license to their referral partners. Some brokerage firms charge additional fees on top of this, but most do not. An even fewer number may pay these fees on your behalf or rebate the charges back to you once your client network is generating a certain amount of trading volume every month to learn more about white label incentive programs like these, please complete the following form.

In addition to fees for setting up, branding and managing your platform see previous sectionoperating a private label business is just like running any other business. There are expenses associated with it. These expenses will normally be lower for partial white label setups, since they will not have the added complications [or fees] associated with accepting customer deposits directly such as making initial and ongoing escrow deposits, setting up merchant accounts for credit card funding, etc, forex trading platform white label.

Depending on your exact business model, you may have to hire people to handle customer education and support, marketing, accounting, management and IT.

Will your business be Internet-based, brick-and-mortar, or both? Depending on your geographical location, this can add a few thousand dollars a month to your list of business expenses. However you decide to structure your white label business, make sure that you first think carefully about all of the expenses you will likely incur prior to getting started, then handle your budget intelligently to give your business a better chance to succeed over the long run.

This is a fact, despite what certain unscrupulous brokerage firms in the industry would like you to believe. The thing is that, like in any business, certain organizations and individuals will have a better edge as white label providers. This should not come as a surprise to anyone.

You would not expect to become a successful brain surgeon without first going to medical school and practicing on a lot of animals, right? The same is true with a white label. For a more specific list of high-probability candidates, you can access the this section of our website.

This list is also relevant for white label partners. If you become a white label broker, what would you have to offer? I would have a white label to offer! Anyone can pay the fees to brand a trading platform like MT4, throw up a generic website, and be up and running pretty quickly, forex trading platform white label.

After all, a white label is a forex trading platform white label label, right? No kidding! If the above information just kind of burst your bubble, then good! Better now than later, after you spend all your time and money trying to fight a losing battle whose only byproduct is a lifetime addiction to Prozac. The truth is that unless you can already generate a huge number of financial or Forex related leads, forex trading platform white label, running a bare-bones business in foreign exchange without providing attractive incentives or value-added services to your clients is equivalent to committing financial suicide.

I recommend that until you have good answers to the questions above, you hold off on the launch of your white label. A failure to heed to this advice is one of the main forex trading platform white label white label organizations eventually fail.

Your white label organization requires a strong foundation. That foundation will be weak unless the brokerage firm that you decide to use, the one that will provide your platform and trade execution, is good.

In fact, the entire success of your business as a private label is piggybacked on the quality and reliability of the broker that you choose. How safe is the brokerage firm you want to work with? How good is their quality of execution?

How flexible are they in working with their IBs and white label partners? In our blog and during client seminars, we have spoken in depth about the importance of working with a broker where client funds are safe.

There are a lot of misconceptions when it comes to this; the most common one being that the bigger the firm, the safer the money. This cannot be further from the truth! Often times, large Forex firms, especially in the United States, have hid behind the false sense of security that investors have been brainwashed with when it comes to big brokers.

Enter into a white label agreement with a firm that goes the extra mile to protect the money of their clients; one that implements additional layers of security like fund segregation and 3rd party administration and monitoring for the sake of its customers. Quality of Execution A high quality of execution is also important when running a trading business.

Remember that if you run a full white label program, forex trading platform white label, your clients will never find out who the actual broker behind your platform is.

Nevertheless, they will still judge you for any poor execution they happen to experience. You cannot allow something like that to ruin your reputation as a firm.

Think about it. If a firm treats you like just a number and does not cater to the specific needs associated with your particular business model, you might as well go elsewhere. Sooner or later, a brokerage firm that is not flexible is going to make your life a living hell. Make sure that they fully understand and will work with you, so that you can put those plans into action quickly and effectively.

Make sure that you work with a brokerage firm that offers account safety, good execution forex trading platform white label, and plenty of flexibility. You owe it to your customers and to the success of your organization. Yes, the platform will still work, but will it portray your brand professionally and attractively in the eyes of your clients? Some preschoolers do a better job at finger painting! Before even getting started in the branded FX space, you need to make sure that your business name, logos, images, and any other visual representation of your brand instills a sense of trust and confidence in your clients.

This is an area where we recommend that you invest time and money to get it done right. Many potential clients will take only seconds to judge your business. Why risk a rejection due to a poor looking logo? One thing that you can do is a study of other FX companies in the industry. How are they doing it? We can analyze your branding initiative and either give you our seal of approval or steer you in a different direction.

To take or not to take? That is the question for a white label partner when it comes to customer deposits. This is an important question to answer. Even though the ideal solution for forex trading platform white label will depend on your specific objectives, each option comes with its set of advantages and disadvantages. One big advantage of not taking deposits and operating as a partial provider instead is simplicity.

In fact, if you go this route, your customers will likely feel more secure because they will know that their accounts and money are with a well known and regulated broker not a new private label brand. This may not be a big deal if you already have a strong, established brand in another complementary market e.

and simply want to extend that brand to FX without dealing with the additional hassles of processing deposits.

However, if your objective is to appear as a full-blown broker and not let your customers know who the actual brokerage firm behind the platform is, this arrangement becomes very disadvantageous. Forex trading platform white label achieve anonymity between your clients and the platform provider, you need to accept deposits yourself. To start, what deposit methods do you plan to offer your clients?

It is true that some clients, especially those opening larger accounts, forex trading platform white label, will fund mainly via wire transfer, which require no special system or forex trading platform white label to process them. Clients with smaller accounts, on the other hand, normally prefer funding via credit card, since from a percentage basis, credit card fees will be relatively lower than wire fees for smaller deposits.

Given the fact that most brokers nowadays tend to absorb the credit card fees on client deposits anyway, this will become an added cost for your business initially if you do the same. How about using a payment system like PayPal, forex trading platform white label, Skrill or Neteller for deposits? The percentage fees associated with these systems are also relatively high, forex trading platform white label, sometimes even higher than for direct credit card funding.

Furthermore, some of these online payment systems consider Forex companies high risk, so they either have a strict and lengthy due diligence process before accepting a forex trading platform white label merchant or may not accept new Forex merchants at all e.

In addition to overcoming the challenge of setting up credit card processing or alternative funding solutions for their traders, full white labels will also have to overcome the additional hurdle of getting clients to trust a relatively new company with their money.

Their clients know that their account funds are in the hands of a well-known and regulated firm. A full white label client, on the other hand, knows that they are sending their funds directly to a broker without a forex trading platform white label track record behind it. Unless that client had a preexisting, trust-based relationship with the broker, funding will become an added challenge.

How To Start Your Own Forex Brokerage In 5 Easy Steps - #3 - White Label Trading Software

, time: 4:26Forex White Label Program | X Open Hub

Start with our Forex White Label Program today. X Open Hub provides a complete front & back end technology and liquidity solution to help you convert your IB business or White Label into your own fully branded, customised brokerage and realise more profits. Even if you aren't an IB or White label, we can help you get started with an express start The Benefits of Having a White Label Trading Software for Your Brokerage. Forex is a good opportunity to invest, but also make money and increase your wealth. It is worth it to learn how to trade Forex, however, there are some conditions that you have to meet to become a profitable Forex With White Label, you can significantly reduce your start-up cost and time to enter the forex market: Set-Up Cost – Low entry cost compared to buying your own Meta Trader 4 server license Operating Costs – Lower your monthly cost by outsourcing Server Management

No comments:

Post a Comment