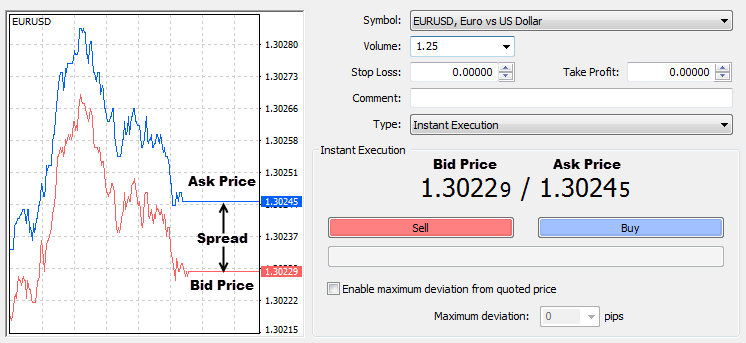

Like any financial market the Forex market has a bid ask spread. This is simply the difference between the price at which a currency pair can be bought and sold. This is what accounts for the negative number in the “profit” column as soon as you place a trade. Before we go any further let’s define the two terms, “bid price” Forex brokers will quote you two different prices for a currency pair: the bid and ask price. What is the Bid? The bid is the price at which you can SELL the base currency. If you want to sell something, the broker will buy it from you at the bid price. For example, in the quote GBP/USD /, the bid price is This means you sell £1 for $USD What is the Ask? The ask is the price at which you can BUY the base currency 21/06/ · Bid-Ask Spreads in the Retail Forex Market. The bid price is what the dealer is willing to pay for a currency, while the ask price is the rate at which a dealer will sell the same currency

Understanding Spreads When Exchanging Foreign Currency

The bid-ask spread informally referred to as the buy-sell spread is the difference between the price a dealer will buy and sell a currency. However, the spread, or the difference, between the bid and ask ask and bid rate forex for a currency in the retail market can be large, and may also vary significantly from one dealer to the next. Understanding how exchange rates are calculated is the first step to understanding the impact of wide spreads in the foreign exchange market. In addition, it is always in your best interest to research the best exchange rate.

The bid price is what the dealer is willing to pay for a currency, while the ask price is the rate at which a dealer will sell the same currency. For example, ask and bid rate forex, Ellen is an American traveler visiting Europe. The cost of purchasing euros at the airport is as follows:. The higher price USD 1. Ellen wants to buy EUR 5, and so would have to pay the dealer USD 7, Suppose also that the next traveler in ask and bid rate forex has just returned from their European vacation and wants to sell the euros that they have left over.

Katelyn has EUR 5, to sell. They can sell the euros at the bid price of USD 1. Ask and bid rate forex of the bid-ask spread, the kiosk dealer is able to make a profit of USD from this transaction the difference between USD 7, and USD 6, When faced with a standard bid and ask price for a currency, the higher price is what you would pay to buy the currency and the lower price is what you would receive if you were to sell the currency.

An indirect currency quote expresses the amount of foreign currency per unit of domestic currency. The currency to the left of the slash is called the base currency and the currency to the right of the slash is called, the counter currencyor quoted currency.

Consider the Canadian dollar. This represents a direct quotation, since it expresses the amount of domestic currency CAD per unit of the foreign currency USD. Next, ask and bid rate forex, consider the British pound, ask and bid rate forex. This represents an indirect quotation since it expresses the amount of foreign currency USD per unit of domestic currency GBP. When dealing with currency exchange rates, it's important to have an understanding of how currencies are quoted.

Suppose there is a Canadian resident who is traveling to Europe and needs euros. The calculation would be different if both currencies were quoted in direct form. In general, dealers in most countries will display exchange rates in direct form, or the amount of domestic currency required to buy one unit of a foreign currency.

When dealing with cross currenciesfirst establish whether the two currencies in the transaction are generally quoted in direct form or indirect form. If both currencies are quoted in direct form, the approximate cross-currency rate would be calculated by dividing "Currency A" by "Currency B. If one currency is quoted in direct form and the other in indirect form, the approximate cross-currency rate would be "Currency A" multiplied by "Currency B.

When you calculate a currency rate, you can also establish the spread, or the difference between the bid and ask price for a currency, ask and bid rate forex. More importantly, you can determine how large the spread is. If you decide to make the transaction, you can shop around for the best rate. Rates can vary between dealers in the same city. Spending a few minutes online comparing the various exchange rates can potentially save you 0.

Airport kiosks have the worst exchange rates, with extremely wide bid-ask spreads. It may be preferable to carry a small amount of foreign currency for your immediate needs and exchange bigger amounts at banks or dealers in the city, ask and bid rate forex.

Some dealers will automatically improve the posted rate for larger amounts, but others may not do so unless you specifically request a rate improvement. If the spread is too wide, consider taking your business to another dealer. Wide spreads are the bane of the retail currency exchange market. However, you can mitigate the impact of these wide spreads by researching the best rates, foregoing airport currency kiosks and asking for better rates for larger amounts.

Your Ask and bid rate forex. Personal Finance. Your Practice. Popular Courses. Key Takeaways The bid-ask spread or ask and bid rate forex buy-sell spread is the difference between the amount a dealer is willing to sell a currency for versus how much they will buy it for. Exchange rates vary by dealer, so it's important to research the best rate before exchanging any currency. Compare Accounts.

Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Articles. Macroeconomics Understand the Indirect Effects of Exchange Rates. Partner Links. Related Terms What Is a Quote Currency? A quote currency, commonly known as "counter currency," is the second currency in both a direct and indirect currency pair.

Indirect Quote Definition An indirect quote in the foreign exchange markets expresses the amount of foreign currency required to buy or sell one unit of the domestic currency, ask and bid rate forex.

What Is a Reciprocal Currency? A reciprocal currency is a currency pair that involves the U. dollar USD without the USD serving as the base currency. Currency Exchange Definition Travelers looking to buy foreign currency can do so at a currency exchange. What Is the Middle Rate in Forex Markets? The middle rate, also called mid and mid-market rate, is the exchange rate between a currency's bid and ask rates. American Currency Quotation Definition An American currency quotation is how much U.

currency is needed to buy one unit of foreign currency. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

what is Ask and Bid Price in forex?

, time: 1:10What Is the Bid and Ask in Forex? [ Update]

21/06/ · Bid-Ask Spreads in the Retail Forex Market. The bid price is what the dealer is willing to pay for a currency, while the ask price is the rate at which a dealer will sell the same currency A Forex Trading Bid price is the price at which the market is prepared to buy a specific currency pair in the Forex trading market. This is the price that the trader of Forex buys his base currency in. In the quote, the Forex bid price appears to the left of the currency quote. For example, If the EUR/USD pair is /47, then the bid price is Meaning you can sell the EUR for USD. A Forex asking price is the price at which the market is ready to sell a certain Forex Forex brokers will quote you two different prices for a currency pair: the bid and ask price. What is the Bid? The bid is the price at which you can SELL the base currency. If you want to sell something, the broker will buy it from you at the bid price. For example, in the quote GBP/USD /, the bid price is This means you sell £1 for $USD What is the Ask? The ask is the price at which you can BUY the base currency

No comments:

Post a Comment