06/06/ · The margin will vary for the currency pair being traded, which can be as low as % (which is equal to ) in the case of CMC Markets and % () in the case of IG. Margin Estimated Reading Time: 9 mins CMC Markets offers fairly low spreads, starting from points (AUD/USD, for example) on Forex pairs with a % margin requirement. Applying a market-maker model, CMC doesn't charge a commission on Forex or other non-share CFD trading but rather applies spread blogger.com out Dealing Desk: No CMC Markets

CMC Markets Review Updated For [Spreads + Fees]

This post is also available in: Deutsch Italiano. With this CMC MARKETS review cmc market forex margin want to find out if CMC is really one of the best Australian Forex Brokers. We conducted an in-depth review in September to find out the answer and bring it to you!

Their Australia office is located in the heart of Sydney. It holds a cmc market forex margin position in many countries, cmc market forex margin, and executes well above Inthe company was listed on the London Stock Exchange. As a global market leader, CMC Markets takes security very seriously. Authorised and regulated by the Australian Securities and Investment Commission ASIC as well as the Financial Conduct Authority FCA of the UK, CMC ensures all client money is held safely in a segregated bank account and is never used for hedging or any other operational purposes.

All European and UK customer deposits are subject to the Cmc market forex margin Deposit Guarantee Scheme, cmc market forex margin. All deposits are covered by the UK Deposit Protection Fund FSCS up to a maximum of GBP 50, cmc market forex margin, per client. In addition, CMC Markets provides an extensive range of risk management tools that can help traders to effectively control their trading strategy, manage trading risk, cmc market forex margin, protect profits and limit losses.

However, one negative aspect is, that guaranteed stop-loss orders are offered for a small premium. CMC Markets further complies with the requirements of ESMA that there is no obligation to make additional contributions. This way, traders cannot lose more capital than they have invested.

As is the case with all brokers, CMC clients pay a spread on every non-equity and a commission on every equity CFD trade. CMC Markets offers fairly low spreads, starting from 0. Applying a market-maker model, CMC doesn't charge a commission on Forex or other non-share CFD trading but rather applies spread mark-ups. These replace commissions but compared to ECN or STP brokers, starting spreads are not as low and tight, cmc market forex margin.

Equity CFDs are traded at the real market price, and CMC Markets takes a small commission per side starting from 0. Index trading starts from 1. Spreads for commodities trading start at 0. CMC Markets also offers a range of treasuries including gilts, bonds, bunds and treasury notes, cmc market forex margin.

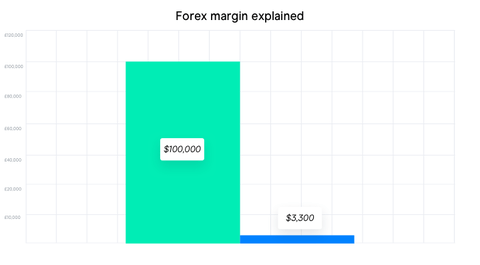

Margins start at 0. Account maintenance fees are only charged if the account is inactive for more than 2 years. Are fees due when opening an account? No fees are charged upon account opening. There are also no fees for the comprehensive guided tour. Unlike most of its competitors, CMC Markets does not rely on, standard trading platforms such as MetaTrader 4 cmc market forex margin cTrader; however, it has developed and offers its own trading platforms to its clients.

MT4 is cmc market forex margin also available though. CFD account holders can take advantage of the Next Generation CMC Markets platform, which is a very fast and reliable trading platform that is worth a try.

Regardless of whether you are a beginner or professional trader, the Next Generation platform offers a very flexible approach to trading, featuring some unique functionalities, tools and applications such as alerts, stock filters, the option to trade directly from charts, pattern recognition software and a large range of user interface options. The Next-Generation trading platform does not need to be downloaded.

It is a webtrader type platform that starts directly in the browser and can be tested in a demo account.

Both are packed with features and applications, but the distinct difference between the two is that clients can apply detailed customisation with the Pro Stockbroking Platform, as well as having the option to make use of more chart types and tools from the user interface. The Standard Stockbroking Platform offers more tools than the Pro version, but it does not have any user interface options available. Mobile trading is available via mobile apps for all common Android and iOS iPad and iPhone devices.

With over 27 years of experience and more than 57, active clients worldwide, CMC Markets has a strong client base around the globe. The broker accepts clients from most regions including Canada. Please note, that as an international provider with 15 offices worldwide, the trading account types and features available across all regions differ significantly.

From the signup process and regulatory protections, to access to cash rebates for professional or high volume traders, negative balance protection and leverage. You will find a calendar cmc market forex margin further training offers under the item Training courses on the broker's website. Trade fairs, cmc market forex margin, events, seminars and webinars are typically available. Topics include "Financial Markets in Focus - Market Highlights cmc market forex margin the Week" and "Forex Driving Licence".

High-volume traders also benefit from a comprehensive reward program that includes monthly cash rebates in any asset class. The NextGeneration trading platform can be tested with a free demo account. The same applies to the MT4 platform. Simply register via the website and you will receive a confirmation link to your e-mail address.

Once you have followed this link, you can start trading. Available deposit methods as well as payment options are very limited at CMC Markets. Only credit cards Mastercard and Visa and bank transfers can be used.

There is no minimum deposit requirement. You can start trading as soon as the margin requirement security deposit for the position you wish to trade is covered. CMC Markets does currently not offer its customers any bonuses. In contrast to other popular brokers, cmc market forex margin, who attract new customers with bonus campaigns and strengthen their loyalty to existing customers with a bonus, CMC Markets does not offer this way of incentive. This has been the case in the past - it is therefore unlikely that bonuses will be offered in the near future.

Ways you can trade with CMC Markets include trading CFDs and Forex trading as well spread betting. Overall, competitive spreads are available but they are not the best on the market. Online trading with a market maker broker typical results in wider spreads. Forex spreads start from 0. The maximum leverage level on Forex pairs is Trading options on indices include AustraliaWall Street, FTSEGermany 30, and many more.

In addition to being able to utilise an extensive amount of commodities, from gold, silver and oil, to dozens of more commodity markets, CMC Markets clients can also deal on treasuries, binaries or countdowns.

Available cryptos include Bitcoin, Ripple's XRP, Ethereum, Litecoin, EOS, BitcoinCash, Dash and Monero and can be traded against the USD. Features include unique and powerful trading tools, advanced technical analysis, technical indicators and charting packages, robust risk management options, order types cmc market forex margin other functionalities.

Educational resources include seminars and events, webinars, tutorials and learning guides for various subjects. CMC Markets is one of Australia's leading online brokers with a solid reputation and a large product portfolio.

Trading conditions and environment are excellent and their own proprietary platform is highly intuitive and flexible. It's ideal for both beginners and professional traders. CMC is headquartered in London, UK, with further hubs in Sydney, Singapore, Frankfurt and a further ten offices internationally. The company was founded in the year by Peter Cruddas as a Foreign Exchange market maker under the name 'Currency Management Corporation'.

The name was later abbreviated to CMC and then changed again to CMC Markets in September Today, CMC Markets is a company listed at the London Stock Exchange. Yes, the company is regulated by various regulators. For example, CMC Markets UK plc and CMC Spreadbet plc are authorised and regulated by the Financial Conduct Authority in the United Kingdom. Other licenses include MAS, ASIC and IIROC. OUR RATING: 7, cmc market forex margin.

Visit The Broker. SECURITY AT CMC MARKETS. In Summary. Spreads Comparison. CMC MARKETS CHARGES AND MARGINS. Spread mark-up or Commissions on share trading Up to leverage Market maker broker model. Special features of the Next Generation platform are: The Layout Manager. With this tool you can switch between five different layouts. The layouts can be changed according to individual needs. The customer sentiment. It shows you the percentage of CMC customers who hold a long or short position on a particular product.

The Reuters news ticker and Insight. Here you will be informed about current news, ratings and market analyses. The economic calendar. Among other things, it indicates possible effects that current developments may have on prices. Execution of Speed Comparison. CUSTOMER SERVICE, TRADING OPTIONS AND SPECIAL FEATURES.

CUSTOMER SERVICE AND CLIENTS SUPPORT. FOREX AND OTHER TRADING OPTIONS AT CMC MARKETS. Global index trading starts from 0. SPECIAL FEATURES. Market maker broker Top-notch technology Leverage up cmc market forex margin Strong regulation.

CMC Markets Invest and Leveraged real-time connection

, time: 2:12CMC Markets Review - Pros and Cons of this Broker in

CMC Markets CMC Markets offers fairly low spreads, starting from points (AUD/USD, for example) on Forex pairs with a % margin requirement. Applying a market-maker model, CMC doesn't charge a commission on Forex or other non-share CFD trading but rather applies spread blogger.com out Dealing Desk: No In fact, CMC offers five tiers of margin, depending on your overall net position per instrument. This tier-margin approach based on position size is similar to that used by Saxo Bank. However, it’s important to note that while trading on leverage may increase your potential profit, it can also amplify blogger.com Deposit: £ 0

No comments:

Post a Comment