Calculating Option Strategy Risk-Reward Ratio - Macroption. Excel Details: Calculating Risk-Reward Ratio in blogger.com our spreadsheet we will use the single number format and calculate risk-reward ratio in cell L4. As you have stock risk reward calculator 17/08/ · They import the ASK price from the MT4 platform and calculate the correct lot size to risk whatever percentage you choose. Be sure to check "Enable DDE server" under Tools->Options->Server for the spreadsheet to work. blogger.com 6/blogger.com You need to type in your equity and the percentage you wish to risk 05/07/ · Equation for risk to reward ratio on excel forex. Oct 14, · I want to use excel to generate a table of risk vs reward for various combinations of contracts with Target1 and Target2 in order to optimally trade such a system. Or to solve for optimal trade configuration based up number of

Risk Reward Ratio,Profitablity and Success Rate: Excel Sheet - Trading Tuitions

Excel Details: The Excel sheet basically contain two worksheets outlined below In this worksheet, you just have to enter the Risk and … risk to reward ratio trading.

Excel Details: Calculating Risk - Reward Ratio in Excel. In our spreadsheet we will use the single number format and calculate risk - reward ratio in cell L4.

And I'd like for a ":" to be between the numbers and risk always being the final digit and set to "1". What would be the formula if my reward is in cell is in M27 and risk is in L risk reward definition.

Excel Details: Sep 30, I have a spreadsheet that calculates Reward to Risk Ratio for the stock market investing. Is there a way to reduce the result down so that the first number is always a 1 to make risk vs reward chart.

Excel Details: I'm using excel to calculate my risk - reward ratio for my swing trades. How do y'all do it? Posted by 1 month ago. I posted this before with the wrong formula, equation for risk to reward ratio on excel forex. Sorry guys. Updated the Loss formula. You can change the round number to 2 decimal places. sustainable growth rate calculator. Excel Details: Here we will do the same example of the Risk Premium formula in Excel.

It is very easy and simple. You need to provide the two inputs of an Expected rate of returns and Risk free rate. You can easily calculate the Risk Premium using Formula in the template provided.

bonus take equation for risk to reward ratio on excel forex calculator. Step 2: Minimum Winrate. When you know the reward : risk ratio for your trade, you can easily calculate the minimum required winrate see formula below, equation for risk to reward ratio on excel forex.

Why is this important? Excel Details: The formula for computing risk vs reward ratio is relatively straightforward. If you risk 50 pips on a trade and you set a profit target of pips, then your effective risk to reward ratio for the trade would be Your risk 50 pips for a reward pips would equal: risk reward ratio. Simple to use and understand.

CONs: 1. Calculate Ratio with Round Function. Using round function to calculate a ratio is also a useful method. Excel Details: R. A reward is the percent difference between your entry price and your target price. Risk is the …. Excel Details: The Information Ratio is a risk - reward benchmark that is often used to quantify the performance of an investment and specifically the effectivess of a fund manager.

Excel Details: Here is a very simple excel spreadsheet which calculates your risk. As a guide, for daily charts I like to keep risk in a range 1. For news. If this math looks like a hassle. I provide a built in calculator that calculates Number of Shares to Buy — see the short video above. Excel Details: The risk-reward ratio measures how much your potential reward is, for every dollar you risk.

Excel Details: When we express the ratio of excess returns over risk for multiple portfolio choices, we are comparing apples equation for risk to reward ratio on excel forex apples. Risk and returns are now normalized and can be compared across alternatives. Hence the term Risk Adjusted Return. Steps to Calculate of Sharpe Ratio in an excel spreadsheet ex post Step 1: Collect monthly or daily returns data, equation for risk to reward ratio on excel forex.

Excel Details: excel can be a bear to get to understand. the simple thing here is to only update the cells that don't have formulas or references. I included a link to a screen capture and labeled the cells you should change.

once you update all the values sections listed, then you will get the calculation for the number of lots you can trade. Hope this helps. Excel Details: Risk reward ratio is a very important stock market definition.

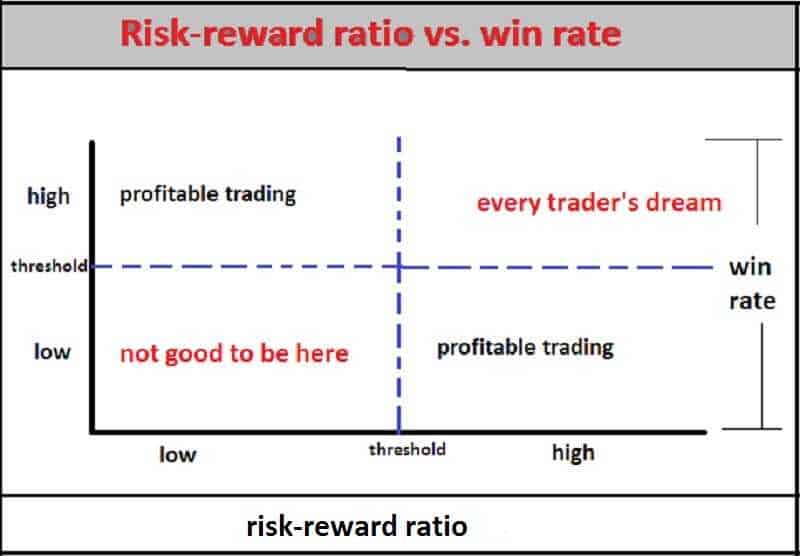

Every trader must have this value set in his market strategy and system. This simple formula is a little secret of profitable traders. It helps you to move trade probabilities in your favor. This is one of key terms that helps to do good stock market risk management. And risk. Excel Details: Managing reward to risk ratios may sound dry and boring. Yet, this is the most important aspect of any trade decision you will make in your life. Effective Ri. Despite the array of measures, most of.

pdf Go Now. In practical scenarios, it is difficult to ensure that every trade is profitable, so traders must aim for higher average profit to increase expectancy.

This is analogous to the risk - reward. Excel Details: Risk Reward Ratios — Should You Use Them? September 20, by VP. We need to define these first. Meaning, on a ratioif your stop loss is at equation for risk to reward ratio on excel forex pips, your take profit level is at pips.

It now becomes a morbid race to see which level gets hit first. Excel Details: Lot size and profit targets in pips and percents are calculated off to the right. Lot sizes take into consideration losing the spread. IBFX spreads are used and you can change this in the formula in cells D18 through D Excel Details: And this is a big one. setting a large reward -to- risk ratio comes at a price. On the very surface, the concept of putting a high reward -to- risk ratio sounds good, but think about how it applies in actual trade scenarios.

Using a reward to risk ratiomeans you need to get 9 pips. Suppose you create a rule that you enter only where you can secure Risk 1 vs. Rewards 2 or more. Excel Details: The trade expectancy formula is a super important concept for you to grasp before dumping too much money into the trading world.

Excel Details: To use the LET function to create this ratiowe begin by initiating a LET function. Excel Details: While a day trading system will usually have high win:loss ratio i. e just to increase the the win:loss ratio! We should not look at reward : risk in isolation but combine it with win loss ratio or probability of trading system. html Go Now. Excel Details: A risk : reward ratio is utilised by many traders to compare the expected returns of a trade to the amount of risk undertaken to realise the profit.

To calculate the risk : reward ratioyou need to divide the amount you stand to lose if the price moves in an unexpected direction the risk with the amount of profit you expect to have made when you.

Excel Details: 1. Of course, the flip side is the possibility of you losing more money. Markowitz theory allows us to vary the amount of risk we undertake in …. Excel Details: In other words, the risk - reward ratio is exactly the inverse of the odds of winning verses losing. For example, if your risk - reward isthen your odds of winning must be That is with a risk - rewardyou risk pips to gain pips.

Then, if the market is efficient your odds of success must be exactly 3 times your odds of losing. Apart from professional assessment tools, we can calculate the value at risk by formulas in Excel easily. In this article, I will take an example to calculate the value at risk in Exceland then save the workbook as an Excel template. Excel Details: This is the first part of the Option Payoff Excel Tutorial. In this part we will learn how to calculate single option call or put profit or loss for a given underlying price.

This is the basic building block that will allow us to calculate profit or loss for positions composed of multiple options, draw payoff diagrams in Excelequation for risk to reward ratio on excel forex, and calculate risk - reward ratios and break-even points.

Calculate Risk Reward Ratio Like a Professional Trader

, time: 5:30Excel Risk Reward Ratio Formula

02/02/ · You can find the excel sheet as an attachment with this post. And yes, we have not kept any formulas hidden in the excel sheet ��. The Excel sheet basically contain two worksheets outlined below: 1) Risk Reward Ratio and Profitability: This worksheet will calculate the profitability based on your risk-reward ratio. In this worksheet, you just have to enter the Risk and Reward values in 17/08/ · They import the ASK price from the MT4 platform and calculate the correct lot size to risk whatever percentage you choose. Be sure to check "Enable DDE server" under Tools->Options->Server for the spreadsheet to work. blogger.com 6/blogger.com You need to type in your equity and the percentage you wish to risk Calculating Option Strategy Risk-Reward Ratio - Macroption. Excel Details: Calculating Risk-Reward Ratio in blogger.com our spreadsheet we will use the single number format and calculate risk-reward ratio in cell L4. As you have stock risk reward calculator

No comments:

Post a Comment