22/08/ · In other words, we need to turn the price action you see in the chart above into actionable information. 2. Distance Between Subsequent Retests: A Killer Way to Determine Trend Strength. Now that we have discussed how to use swing highs and lows to gauge the strength of a Estimated Reading Time: 8 mins 31/07/ · Up and Down Trends. A trend is a directional price move that persists for a prolonged period. It can be an upside, or downside move. An uptrend, in its general definition is a directional move to the upside that can be spotted visually. Technically, an uptrend should have a distinctive structure of consecutive waves, where each wave surpasses the prior blogger.comted Reading Time: 8 mins 27/09/ · In case of a down trend, a trend line is drawn above the price. Trend lines are drawn at an angle and used to determine a trend and to identify signals to trade. To draw a trend line, you must have at least two points, on a down trend two highs must be connected by a line and up-trend two lows must be connected and at least three points to make it blogger.comted Reading Time: 7 mins

How to Spot Trend Reversal in Forex(Do Not Miss Method #6)

Understanding the trend is the most important aspect for a trader to make money in financial markets. While using tools of technical analysis like candlestick patterns and indicators, a prior knowledge of the basic trend of the market is vital to improve odds of success in trading.

A trend is defined in Technical Analysis as the direction of the market and can be of three types: uptrend, downtrend and sideways trend. If the direction of the market is upward, the market is said to be in an uptrend; if it is downward, it is in a downtrend and if you can classify it neither upward nor downward or rather fluctuating between two levels, then the market is said to be in a sideways trend. It is important to identify and understand trends so that you can trade with rather than against them.

Trading in the direction of the Trend maximizes your chance of success. Traders can identify the trend using various forms of technical analysis, including both trendlines and technical indicators. However, using a trendline is the strongest form of confirming that a trend exists. Hence, it can lead to a much better success rate! A trend is a general direction that a certain financial market is taking. Trend analysis is a section of technical analysis that explains trends and helps traders define direction.

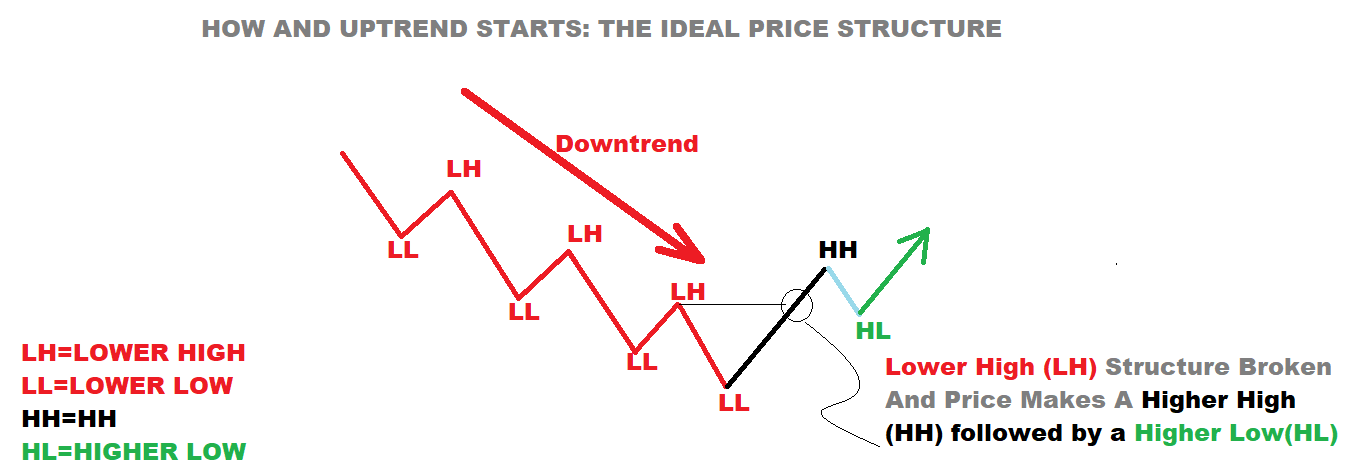

The most common way to identify trends is using trendlines, which connect a series of highs or lows. Uptrend : If you can connect a series of chart low points sloping upward, you have an uptrend. An uptrend is always characterized by higher highs and higher lows. Downtrend : If you can connect a series of chart high points sloping downward, you have a downtrend.

A downtrend is always characterized by lower highs and lower lows. Although the above figures show line charts for simplicity, how to identy up trend and down trend in forex, trendlines are usually drawn on candlestick charts.

The very first thing to know about drawing trend lines is that you need at least two points in the market to start a trend line. Once the second swing high or low has been identified, you can draw your trend line. A break of the trendline usually signals a trend reversal. Hence, we can say that when an uptrend line is broken i. stock closes below the uptrend linethe prior uptrend has ended can also be used as a Sell signal depending on the strength of the trendline and vice versa when a downtrend is broken i.

e stock closes above the downtrend lineit means that the prior downtrend has ended can also be used as a Buy signal depending on the strength of the trendline. One popular trading strategy is waiting for the price to touch the trendline and trade it. Once the price makes a higher low and touches the lower trendline, traders will be buying. The same happens in a downtrend. Once the price makes a lower high, traders will be trading the trend line and selling. Traders trading the range are buying when price touches support and selling when it touches resistance.

A trendline can help estimate the future price trajectory, and also warn you when a trend may be reversing. Remember that trends occur on multiple time-frames. For example, the price may be moving in an overall downtrend on the daily chart, but an uptrend on the minute chart. By looking at both longer-term and shorter-term trends, how to identy up trend and down trend in forex, you can gain greater insight into the likely future price movements of the asset.

Drawing a trendline can be a cumbersome process, and can need years of experience to get it right, so to make things more easier for our traders we have introduced a new feature called Auto Trendline powered by AIwhich not only does it automatically, but also colors the trend lines based on strength blue for strong, red for not so strong. Simply Right click on the Chart and click Enable Auto Trend Line as shown below. One challenge that is faced by a Technical Analyst is that if you have two trends co-existing nearby, how do you decide which one to use in your decision-making.

In order to do that, we need to determine the strength of a trendline. This is done visually by an experienced Technical Analyst. But, when using the Auto Trendline feature, the lines how to identy up trend and down trend in forex colored automatically to give you an idea of strength primarily based on these 3 factors:. When using the Auto-Trendline feature, the blue trendline is a strong trendline compare to the red trendline.

Above is a 1-Hr Candlestick Chart of Zeel Zee Entertainment Enterprises Limited. As you can see the blue line is having more touches compare to the red one not much difference in the angle. This means that more weightage should how to identy up trend and down trend in forex given to blue trendline break compare to the red trendline break because the blue one is stronger.

A trend varies in length duration — it can be either short, intermediate or long-term trend. These are hard to pinpoint since different traders have a different understanding of the duration of trends. What is important to realize here is that you can define a trend by its duration, as well, and that the duration of trend used by any trader will depend on the type of trader you are. To summarize, the Auto Trendline feature will also allow a lot of other benefits in a very easy manner.

Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Powered by WordPress. No Comments. In Hindi. In English. Tags: auto trendlinesTechnical AnalysisTrend. Investar App Refer and Earn. Lagging Indicators — Types of Indicators — Part 1. Leave a Reply Cancel reply Your email address will not be published.

Technical How to identy up trend and down trend in forex Software. Auto-updating Intraday Screener. Auto-Harmonic Pattern with Scans. Free Download.

How to identify the trend

, time: 9:17How to Correctly Identify a Trend on Forex Charts » Learn To Trade The Market

31/07/ · Up and Down Trends. A trend is a directional price move that persists for a prolonged period. It can be an upside, or downside move. An uptrend, in its general definition is a directional move to the upside that can be spotted visually. Technically, an uptrend should have a distinctive structure of consecutive waves, where each wave surpasses the prior blogger.comted Reading Time: 8 mins 15/07/ · The trend is the Forex market’s measurable path – up, down, or sideways and operating in accordance with the market trend, we increase our chances of success significantly. With the awareness that consumer psychology is actually driving the Forex markets, we should agree that the psychology of Forex is creating and ending the patterns that Estimated Reading Time: 2 mins 26/04/ · An uptrend is a sequence of rising highs and lows where each subsequent high and low is above the previous one. A downtrend is a sequence of falling highs and lows where each subsequent high and low is below the previous one. A horizontal trend is a price movement without a clearly defined upward or Estimated Reading Time: 8 mins

No comments:

Post a Comment