22/03/ · The ratio between the investment required and the value of a position is called leverage. Trading with leverage is also known as margin-based trading. Best Ways to Use Leverage in Forex Trading. Given below are some best ways to use leverage in forex trading; 1) Choose appropriate leverage. Careful selection of leverage is vital in forex trading 08/10/ · Forex Leverage is the ratio of the trader’s funds to the size of the broker’s credit (for example, ). Brokerage accounts allow the use of leverage through margin trading, or in other words, brokers provide the borrowed funds to traders to increase trading positions. The leverage ratio can amplify both profits as well as blogger.comted Reading Time: 7 mins 27/02/ · This means when you trade them you don’t need to put all of the money up front. Instead, the broker asks for a certain percentage to cover the transaction. This amount is held on margin and allows what’s called leveraged trading. Leveraged trading means that you can control much bigger position sizes than you would otherwise. Forex ExampleEstimated Reading Time: 8 mins

Best Ways To Use Leverage In Forex Trading | TradingDominance

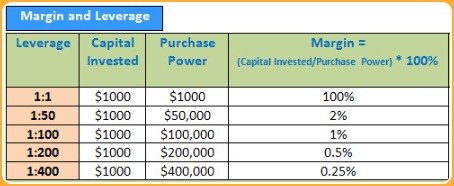

As we mentioned in a previous chapter, one of the biggest advantages for trading Forex is leverage. With leverage, a little money can make a whole bunch if you are right, but leverage works two ways and losses can mount in a hurry when you are wrong. Learn in this article how to properly use leverage in Forex trading and how to avoid the risks of being over-leveraged and blow up your account.

The surest way to have a quick unprofitable ending to your trading career is to use too much leverage. It should be noted that Forex gives the trader the capability of using high leverage, and this can be dangerous only IF the trader does not know how to use it properly. If a trader chooses a broker with higher leverage, it can be very beneficial to him providing he does not maximize the leverage capability granted by the broker.

For instance, the benefit of a broker is that the margin is a super-low 0. So long as the trader does not abuse this privilege, he does not have to worry about a margin call.

Note: A trader cannot open a trading position that exceeds his available margin, and when the available margin reaches 0, he gets a margin call. While a trader can benefit from opening up an account at a broker with high leverage, it would be absolutely dangerous for him to use a significant part of that leverage for any given trade.

If a trader chooses a broker with high leverage, such asit would be impossible for him to use the maximum available leverage because he would be too close to a margin call. As you can see from the above table, the ideal leverage to trade with is either oras this gives you the ability to afford 25 to 12 how to use leverage in forex trading trades in a row and to still be in the game.

Once you exceed leverage, you are playing a dangerous game with leverage, how to use leverage in forex trading. The other leverage scenarios are insane. If you would like to know more about how to properly distribute the leverage and lot sizing between the different trading systems to stay within sound money management principles, please read our complete article How to Distribute Leverage and Lot Sizing Between Trades, how to use leverage in forex trading.

Add the following code to your website to display the widget. You may override the default styles with your own. Articles menu How to Properly Use Leverage in Forex. Learn More If you would like to know more about how to properly distribute the leverage and lot sizing between the different trading systems to stay within sound money management principles, please read our complete article How to Distribute Leverage and Lot Sizing Between Trades.

Cashback Forex Drawdown Calculator Add the following code to your website to display the widget. You may override the default styles with your own Click here to set your own styles Top pane styles background: white; border: solid 1px black; border-bottom: none; color: black.

Bottom pane styles background: white; border: solid 1px black; color: black. Button styles background: black; color: white; border-radius: 20px. Preview Reset. Display tool title. Language Browser language Page language Čeština Deutsch English Español Filipino Français Hrvatski Indonesia Italiano Magyar Polski Português Română Tiếng Việt Türkçe Ελληνικά Български русский العربية فارسی ไทย 中文 한국어 日本語.

Starting balance You must enter a valid number. Consecutive losses You must enter a valid number. Ending balance Total Loss Is this article helpful? Share it with a friend HTML Comment Box is loading comments You might also like to read:. Share this page using your affiliate referral link Academy Home.

Learn Forex. What is Forex and How to How to use leverage in forex trading it - Best Beginner's Guide. How to Trade Forex: Step-by-step Guide. How Technical Analysis Works. How Fundamental Analysis Works. How Support and Resistance Works. How Trend Analysis Works. How to Properly How to use leverage in forex trading Risk.

How to Analyze Fundamentals. Best Time to Trade Forex. Why do Most Traders Lose Money in Forex. What are Forex Rebates. Introduction to Automated Trading. Forex Brokers, how to use leverage in forex trading.

Top 5 FX Brokers With Customer's Reviews. Top US Regulated Forex Brokers. Financial and Forex Regulators. Finding the Best Forex Broker: 7 Key Factors.

Benefits of Micro and Nano Lot Brokers. Technical Indicators. Forex Basics. Training Videos. Academy Home. Sign Up. Remember Me. Join our mailing list? Forgotten Password.

Forex Leverage Explained For Beginners \u0026 Everyone Else!

, time: 4:05How to Use Leverage in Forex trading - Forex Trading Leverage Explained - Forex Education

This also means that the margin-based leverage is equal to the maximum real leverage a trader can use. Forex Trading Costs. We will look at examples of Forex trading without leverage and compare them with trading with minimal leverage. However, remember that the Stop Out level with LiteForex is 20%. Brokers who take care of their clients have a 22/03/ · The ratio between the investment required and the value of a position is called leverage. Trading with leverage is also known as margin-based trading. Best Ways to Use Leverage in Forex Trading. Given below are some best ways to use leverage in forex trading; 1) Choose appropriate leverage. Careful selection of leverage is vital in forex trading 08/10/ · Forex Leverage is the ratio of the trader’s funds to the size of the broker’s credit (for example, ). Brokerage accounts allow the use of leverage through margin trading, or in other words, brokers provide the borrowed funds to traders to increase trading positions. The leverage ratio can amplify both profits as well as blogger.comted Reading Time: 7 mins

No comments:

Post a Comment