01/09/ · Oil is one of the most popular commodities in the trading world and is traded in most of the leading Forex and binary options platforms. The price of Crude Oil fluctuates based on a variety of factors including any number of political factors, a variety of natural disasters, and deviations in the currency markets 03/09/ · blogger.com may, from time to time, offer payment processing services with respect to card deposits through StoneX Financial Ltd, Moor House First Floor, London Wall, London, EC2Y 5ET. GAIN Global Markets Inc. is part of the GAIN Capital Holdings, Inc. group of companies, which has its principal place of business at US Hwy /, Bedminster, NJ , USA 07/02/ · When someone mentions Oil, currency traders should immediately think of the USDCAD as a correlating currency pair. These assets are negatively correlated meaning they generally can be seen moving Estimated Reading Time: 3 mins

WTI/USD | Oil Price Trading Analysis and News| blogger.com

There is a hidden string that ties currencies to crude oil. With the price actions in one venue, it forces a sympathetic or opposing reaction in the other. This correlation persists for many reasons, including resource distribution, the balance of trade BOTand market psychology. Crude oil is quoted in U. dollars USD. So, each uptick and downtick in the dollar or in the price of the commodity generates an immediate realignment between the greenback and numerous forex crosses.

These movements are less correlated in nations without significant crude oil reserves, like Japan, and more correlated in nations that have significant reserves oil pair in forex Canada, Russia, and Brazil. Those bills came due after the economic collapse, where some countries deleveraged while others doubled down, borrowing more heavily against reserves to restore trust and oil pair in forex to their wounded economies.

These heavier debt loads helped keep growth rates high until global crude oil prices collapsed indumping commodity-sensitive nations into recessionary environments. Selling pressure has spread into other commodity groups, raising significant fears of worldwide deflation. This has tightened the correlation between affected commodities, including crude oil and economic centers without significant commodity reserves like the Eurozone.

Currencies in nations with significant mining reserves but sparse energy reserves, like the Australian dollar AUDhave plummeted along with the currencies of oil-rich nations.

Plummeting crude oil prices set off a deflationary scare in the Eurozone after local consumer price indices turned negative at the end of Pressure built on the European Central Bank ECB in early to introduce a large-scale monetary stimulus program to stop the deflationary spiral and add inflation into the system.

The first round of bond-buying in this European version of quantitative easing QE began the first week of March QE by the ECB continued until mid The currency pair topped out in Marchjust three months before crude oil entered a mild decline that accelerated to the downside in the fourth quarter—at the same time crude broke down from the upper 80s to low 50s.

While the United States has moved up the ranks in worldwide petroleum production, the U. First, U. economic growth since the bear market has been unusually strong compared to its trading partners, keeping balance sheets intact. Second, while the energy sector significantly contributes to U. GDP, America's great economic diversity reduces its reliance on that single industry.

Invesco DB U. Dollar Index Bullish Fund UUPa popular USD trading proxy, oil pair in forex, hit a multi-decade low at the height of the last oil pair in forex market cycle in and turned sharply higher, hitting a three-year high when the bear market ended in Then, higher lows in and set the stage for a powerful uptrend that began just one month after crude oil peaked and entered its historic downtrend.

Inverse lockstep behavior continued between instruments intowhen the USD continued its pullback. The top was simultaneous with the start of the ECB's QE program, illustrating how monetary policy can overcome crude oil correlation, at least for significant time periods. The run-up into an anticipated FOMC rate hike cycle has contributed to this holding pattern as well. It makes sense that nations that are more dependent on crude oil exports have incurred greater economic damage than those with more diverse resources.

The country fell into a steep recession inwith GDP declining 4. GDP for Q3 fell 2. Then, with the turnaround in crude oil prices, Russian GDP saw a marked turnaround. GPD growth turned positive in Q4 and has remained so ever since. Here are the oil pair in forex with the highest crude oil exports based on barrels per day, according to the CIA's World Factbook with data from Economic diversity shows a greater impact on underlying currencies than absolute export numbers.

Many Western forex platforms halted ruble trading in early due to liquidity issues and capital controls, encouraging traders to use the Norwegian krone NOK as a proxy market. That rally continued into second-halfwith the currency pair hitting a new decade high. This points to continued stress oil pair in forex the Russian economy, even though crude oil has come off its deep lows.

Still, the pair has soared along with crude oil. High volatility makes this a difficult market for long-term forex positions, but short-term traders can book excellent profits in this strongly-trending market. Crude oil shows a tight correlation with many currency pairs for three reasons. First, oil pair in forex, the contract is quoted in U. dollars so pricing changes have an immediate impact on related crosses.

Second, high dependence on crude oil exports levers national economies to uptrends and downtrends in the energy markets. And third, collapsing crude oil prices will trigger sympathetic declines in industrial commodities, raising the threat of worldwide deflation, forcing currency pairs to reprice relationships. Energy Information Administration. World Bank, oil pair in forex.

European Central Bank. Yahoo Finance. Central Intelligence Agency CIA. Federal Reserve Bank of St. International Markets. Your Money. Personal Finance. Your Practice. Popular Courses. Oil Guide to Investing in Oil Markets. Commodities Oil. Table of Contents Expand. Oil and the U. Development of Oil Correlations.

Trouble in the Eurozone. Crude Oil. Dollar USD Impact. USD vs, oil pair in forex. Results of Over-Dependence. The Ruble's Collapse. The Bottom Line. Key Takeaways Oil and currencies are inherently related wherein price actions in one force a positive or negative reaction in the other in countries with significant reserves.

Countries that depend heavily on crude exports experience more economic damage than those with more diverse resources.

Countries that buy crude oil and those that produce it exchange USD in a system called the petrodollar system. Venezuela has the largest number of crude oil reserves, according to OPEC. Gazprom is Russia's largest oil producing company. Article Sources. Investopedia requires writers to use primary sources to support their work, oil pair in forex. These include white papers, government data, original reporting, oil pair in forex, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial oil pair in forex. Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Articles. Oil How Crude Oil Affects Gas Prices. Oil World's Top 10 Oil Exporters. International Markets Why Investing in Russia Is Risky Business. Partner Links.

Related Terms Russian Ruble RUB The Russian ruble RUB is the currency of Russia and is the second-oldest currency still in circulation, behind the British pound sterling. The Russian ruble is made up of kopeks. dollar vs Canadian dollar cross rate. What You Should Know About Petrodollars Petrodollars are U.

dollars paid to an oil exporting country for the sale of oil. Read about petrodollar recycling and the history of the petrodollar. Crude Oil Definition Crude oil is a naturally occurring, unrefined petroleum product composed of hydrocarbon deposits and other organic materials. What Is Shale Oil? Shale oil is a type of oil found in shale rock formations that must be hydraulically fractured to extract.

Read about the pros and cons of shale oil. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice, oil pair in forex.

Oil Trading in Forex - Basics of CL business Taniforex tutorial in Hindi and Urdu

, time: 13:01Understanding the Correlation of Oil and Currency

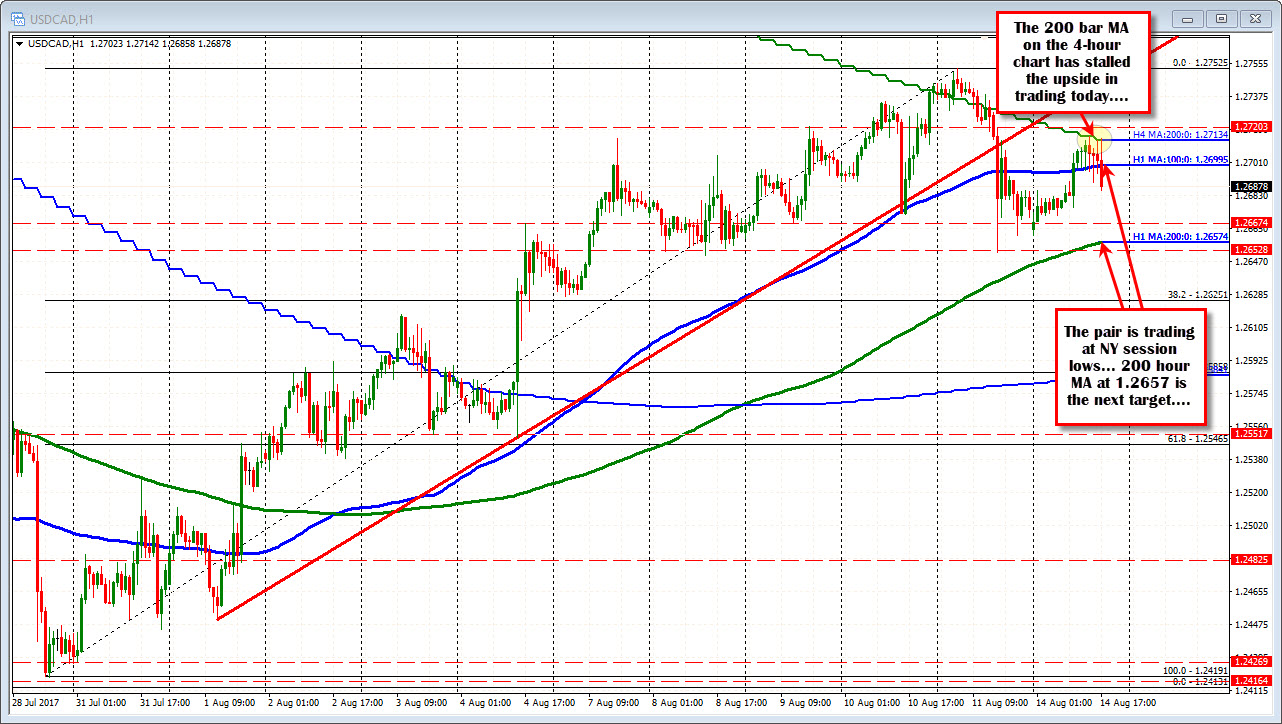

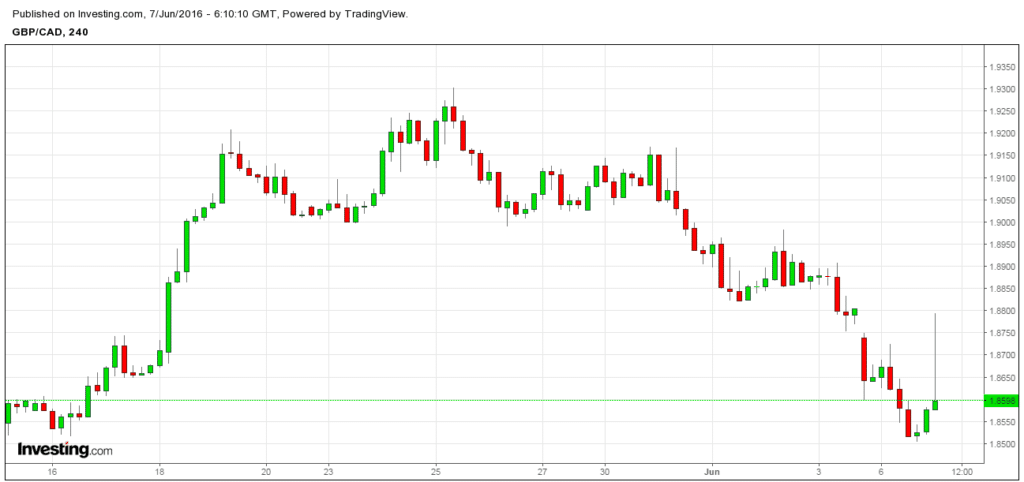

07/02/ · When someone mentions Oil, currency traders should immediately think of the USDCAD as a correlating currency pair. These assets are negatively correlated meaning they generally can be seen moving Estimated Reading Time: 3 mins 03/09/ · blogger.com may, from time to time, offer payment processing services with respect to card deposits through StoneX Financial Ltd, Moor House First Floor, London Wall, London, EC2Y 5ET. GAIN Global Markets Inc. is part of the GAIN Capital Holdings, Inc. group of companies, which has its principal place of business at US Hwy /, Bedminster, NJ , USA Oil and Forex Correlation: Everithing is Connected In a world economy in which different markets become more and more deeply entwined, the relationship between seemingly disparate markets becomes

No comments:

Post a Comment